At JSW Cement, climate-related risks and opportunities are well integrated with our overall risk management process. A multi-disciplinary company-wide risk management process helps in the identification, assessment, and management of several aspects of climate change in terms of fuels availability & cost, energy optimisation, emerging regulations etc. However, a separate exercise of Climate risk/opportunity assessment was undertaken in 2023 aligning with the recommendations of the Task force on Climate-related Financial Disclosures (TCFD) for which we had engaged a third party ‘AXA Climate’. A scenario-based climate change risk assessment exercise was undertaken to determine potential implications of climate risks on our business and operations in short term, medium term and long term. We have identified physical climate risks and transition risks and for each we have considered two scenarios – Business-as-usual and Optimistic.

This note summarizes the outcome of this analysis and how we will build our strategy to mitigate and adapt to the risks identified and leverage on opportunities. This will also help us making our business more resilient towards emerging risks by preparing ourselves in advance.

Physical Risk Assessment

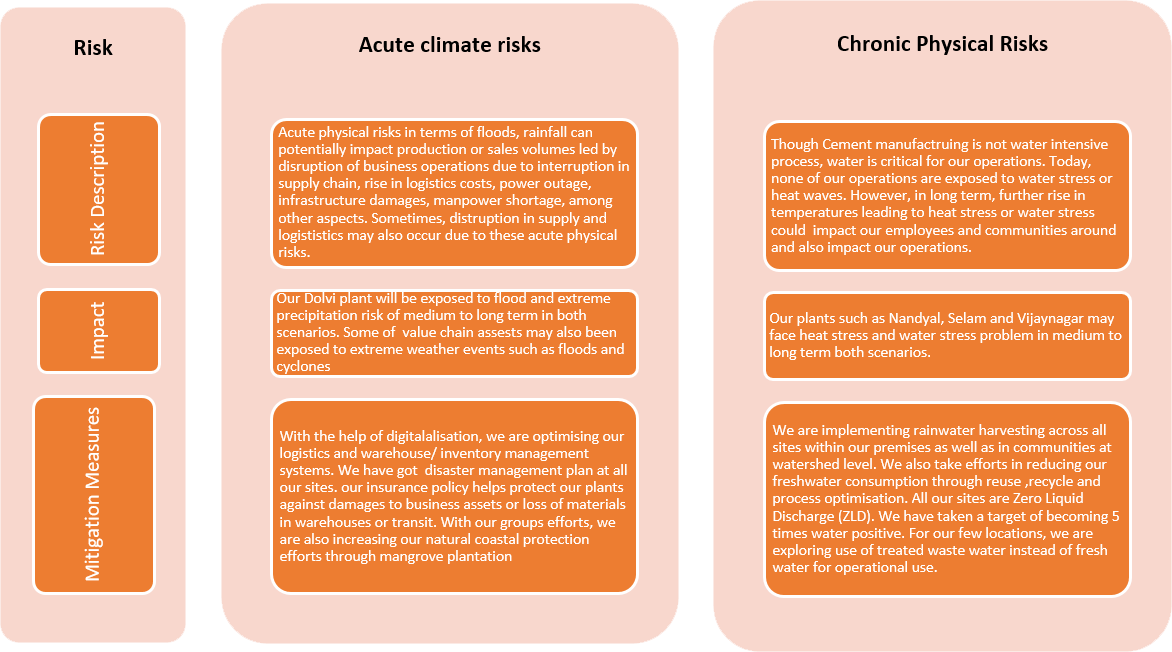

All our operational sites (seven sites), four value chain assets (including two raw material suppliers, one key market) were covered for the risk assessment (for acute and chronic physical climate-related risks).

Shared Socioeconomic Pathways (SSPs) are climate change scenarios of projected socioeconomic global changes up to 2100 as defined in the IPCC Sixth Assessment Report on climate change in 2021. They are used to derive greenhouse gas emissions scenarios with different climate policies. There are five scenarios as depicted in the figure. Out of these five, we have considered two future scenarios - SSP2-4.5 and SSP5-8.5.

Physical Risks |

SSP2-4.5 |

SSP5-8.5 |

|---|---|---|

|

Acute climate risks Chronic climate risks |

This is a “middle of the road” scenario. CO2 emissions hover around current levels before starting to fall mid-century, but do not reach net-zero by 2100. Socioeconomic factors follow their historic trends, with no notable shifts. Progress toward sustainability is slow, with development and income growing unevenly. In this scenario, temperatures rise 2.7C by the end of the century. This is equivalent to RCP4.5 scenario. |

This is a future to avoid at all costs. Current CO2 emissions levels roughly double by 2050. The global economy grows quickly, but this growth is fueled by exploiting fossil fuels and energyintensive lifestyles. By 2100, the average global temperature is a scorching 4.4C higher. This is equivalent to RCP 8.5 Scenario. |

Seven climate perils (as per IPCC classifications) were primarily considered for the risk assessment. Multiperil risk score was calculated for each asset based on its exposition to perils and on the vulnerability depending on the type of building and industry.

Below is the summarised analysis of physical risk assessment

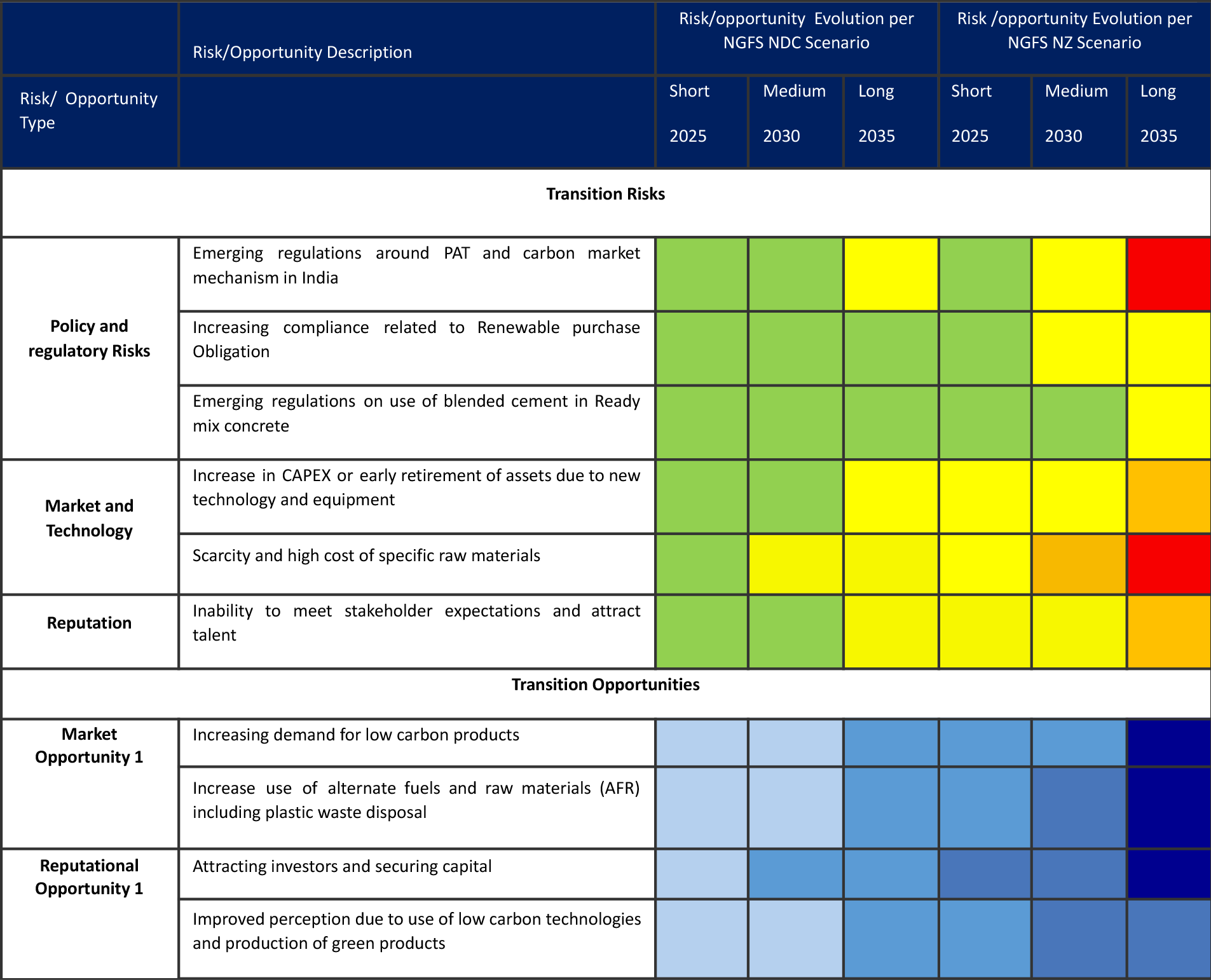

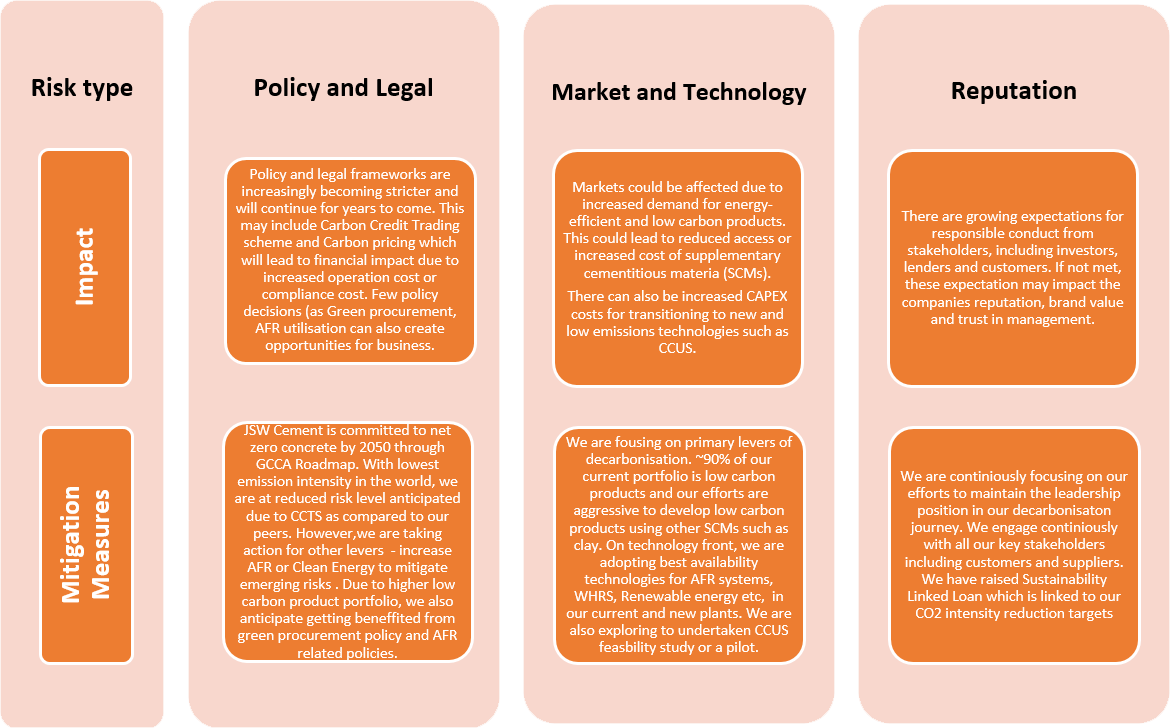

Transition Risk Assessment

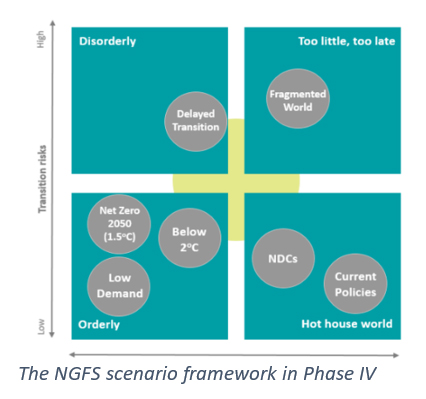

For assessing climate related transition risks and opportunities, we used Network for Greening the Financial System (NGFS) scenarios. The NGFS scenarios framework explores a set of possible transition pathways, depending on different levels of ambition and coordination in terms of climate policies.

We considered Net Zero (NZ 2050) Scenario (Optimistic) and Nationally Determined Contributions Scenario (NDC) by NGFS.

Transition Risks |

NGFS NZ 2050 Scenario |

NGFS NDCs Scenario |

|---|---|---|

|

This scenario assume climate policies are introduced early and become gradually more stringent. Both physical and transition risks are relatively subdued. |

These scenarios assume that some climate policies are implemented in some jurisdictions, but global efforts are insufficient to halt significant global warming. Critical temperature thresholds are exceeded, leading to severe physical risks and irreversible impacts like sea-level rise. |

1 - Governance |

Key Findings/ Current Status |

|---|---|

|

a) Governance of risks and opportunities related to climate change by the Board of Directors |

|

|

b) Management’s role in assessing and managing risks and opportunities related to climate change |

|

2 - Strategy |

Key Findings/ Current Status |

|

a) Risks and opportunities associated with climate change identified |

|

|

b) Impacts of risks and opportunities identified for the organization |

|

|

c) Resilience strategy of the organization, taking into consideration different climaterelated scenarios |

|

3 - Risk Management |

Key Findings/ Current Status |

|---|---|

|

a) Processes in place within the Company to assess risks and opportunities associated with climate change |

|

|

b) Processes in place to manage these risks and opportunities |

|

|

c) Integrating these processes into the Company’s risk management processes |

4 - Metrics and Targets |

Key Findings/ Current Status |

|---|---|

|

a) Indicators used to assess risks and opportunities related to climate change |

|

|

b) Publication of Scope 1, Scope 2, and, if applicable, Scope 3 greenhouse gas (GHG) emissions |

|

|

c) Targets used to assess the risks and opportunities linked to climate change |

|

Basis the assessment conducted; we have also developed a context specific physical climate risk adaptation plan. The plan covers 100% of our existing operations s well as a few of the upcoming operations. We have identified relevant adaptation measures based on severity of each identified risks. The adaptation measures are to be implemented within a timeline of 5-10 years.

For each of the identified risks and opportunities, financial implications on business were also identified using assumption and estimation. This also helped in identifying the time frame to materialise these risks as well as the cost of actions required to mitigate the risks/materialise the opportunity which subsequently help us to make an informed decision.